INDIA

|

India, the USA, and the European Union have unveiled a 4-point roadmap for building resilient supply chains to be based on best-in-class practices of transparency, diversification, security and sustainability.This was announced in a joint statement issued by 17-partner economies on July 20 following a virtual ministerial meet hosted by the US secretary of state Antony Blinken and commerce secretary Gina Raimondo.

|

|

States are learnt to have agreed to support the central government's Gati Shakti scheme. Gati Shakti is a digital platform initiative that will bring together 16 core sector ministries for integrated planning and coordinated implementation of infrastructure projects. The initiatives aims to markedly reduce the project implementation time. The Prime Minister met with state chief secretaries recently to expedite the implementation of the initiative.

|

|

Tata Sons Chairman N Chandrasekaran said that India is well poised to provide solutions to the supply-chain disruptions affecting trade globally. Addressing a convocation ceremony at IIT Madras, Mr. Chandrasekaran underlined an India-plus strategy that covers a vast number of industries - from semiconductors to batteries to new formulations. This requires a lot of "tech talent," he said.

|

|

TVS Supply Chain Solutions has appointed Dr. Tarun Khanna as an independent director to the company's Board. Dr. Khanna is Jorge Paulo Lemann Professor at the Harvard Business School. His scholarly work has been published in several economics, management, and foreign policy journals. He has authored "Billions of Entrepreneurs: How China and India are Reshaping Their Futures and Yours," a book focusing on Asia's entrepreneurship ecosystem. He also serves on several profit and not-for-profit Boards in the U.S. and India.

|

|

FMCG Major HUL has announced the appointment of Yogesh Mishra as Executive Director, Supply Chain, HUL and Head - Supply Chain, Unilever South Asia with effect from September 1, 2022. Mr. Mishra takes over charge from Willem Uijen who has been elevated as the Chief Procurement Officer for HUL, globally said a company statement. Mr. Mishra is presently VP - Supply Chain, Beauty & Personal Care, HUL.

|

|

R Dinesh, Executive Vice-Chairman, TVS Supply Chain Solutions, has been elected CII's President Designate for 2022-23. Mr. Dinesh is also the Chairman of the CII Institute of Logistics, the publisher of this newsletter. He has held several positions in CII as Chairman of National Committees on Logistics, and CII Tamil Nadu State Council, among others. Mr. Dinesh, in a column written for Mint this month, highlighted ways in which GST has benefitted the logistics and manufacturing sectors, and provided a level-playing field to retailers and distributors across the country.

|

|

China's increasing supply-chain constraints and India's localization focus, driven in part by the government's production-linked incentive, can make India a key player in the smartphone manufacturer's manufacturing play, says a Forbes India report.

|

|

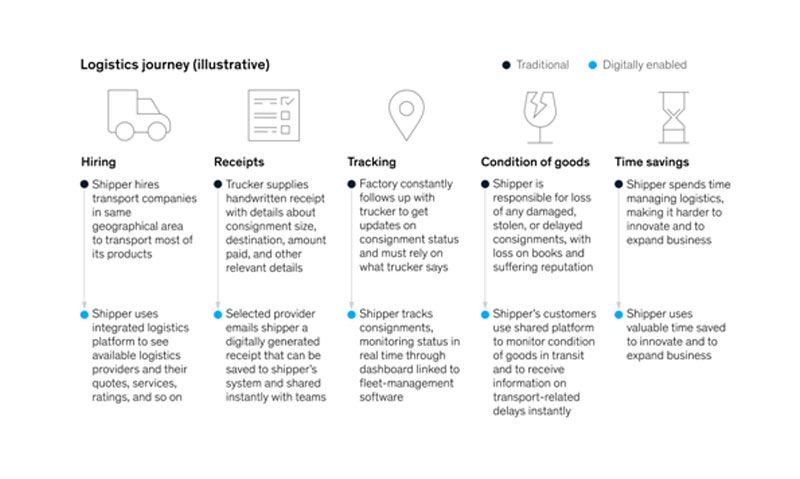

RedCore, a research arm of RedSeer, expects India's road logistics market to grow at a CAGR of 8 percent over the next 5 years. The report highlights five technology trends that will transform the industry during the next few years. They include Artificial Intelligence, Machine Learning, cloud-based systems, and predictive analytics.

|

|

India ranks among the world's biggest suppliers of generics and vaccines. However, the issue of counterfeit and fake medicines continues to be a cause of concern for the industry's stakeholders. They need to focus more on supply chain challenges related to quality, monitoring and enforcement of rules and laws, and the activities of unscrupulous suppliers and operators, says a Financial Express report.

|

|

Shiprocket, the automated shipping solutions company, acquired Arvind's omnichannel tech venture 'Omuni' for a total consideration of Rs. 200 crores, as per an IITL report. The acquisition is meant to enhance customer experience and lead times, said the statement.

|

|

Wheelocity, an early-stage supply chain startup, has raised $12 million for expansion of its network, increasing product offerings and partner network. Wheelocity, founded in September last year, provides quick commerce firms with a supply chain of fresh food, reports TechCrunch.

|

INTERNATIONAL

|

Leaders of the G7 (Group of Seven), joined by the Leaders of Argentina, India, Indonesia, Senegal and South Africa, met in Elmau, Germany, and underscored their resolve to strengthen the resilience of supply chains.They affirmed their commitment to ensuring a highly decarbonized road sector by 2030. The group will also work towards forming new Just Energy Transition Partnerships with Indonesia, India, Senegal, and Vietnam.

|

|

Shippers, logistics providers, ocean carriers and other shipping industry stakeholders that participated in this year's Maritime Data Summit have highlighted four key ocean shipping data problems. Ocean shipping data being provided is inaccurate and limited, forwarders find accessing data challenging, and the pandemic has exacerbated data standard issues, reported the participants.

|

|

The NY, U.S.-based exercise equipment company, Paleton, whose sales surged at the beginning of the pandemic as people looked for ways to keep themselves fit during lockdown, is facing the challenges of an uncertain market. The company announced that it will stop making exercise bikes and treadmills.

|

|

Bentonville, Arkansas, US-based Walmarthas agreed to buy 4,500 electric delivery vehicles from American automaker Canoo.The company will deploy these vehicles to support their growing ecommerce business in a sustainable way. Canoo's fully electric Lifestyle Delivery Vehicle (LDV) is engineered for high frequency stop-and-go deliveries.

|

|

Amazon's Prime Day has so far garnered record sales worldwide, with consumers having purchased more than 100,000 items per minute, according to a company press release. The Sourcing Journal called the event an "execution story" given that logistics providers are confronting and countering major logistical challenges of merchandise planning and inventory optimization to make the event possible.

|

|

A host of factors, such as the ongoing Russia-Ukraine conflict, China's zero-tolerance Covid-19 policy, soaring shipping costs, port congestion, etc. have contributed to causing a multi-trillion-dollar supply chain crisis. These issues are causing delays to delivery of raw material and equipment to industries and changing domestic manufacturing strategies, writes Bryan Fried, Chairman and CEO of PANGEA Global Technologies for the Forbes magazine.

|

|

A growing number of companies on both sides of the Atlantic are looking at reshoring their supply chain. BBC speaks to companies and consultants in the US and UK from industries such as chemicals and food. Executives report grappling with supply chain issues during the past couple years, increasingly considering sourcing locally as part of their supply chain strategy.

|

|

A Gartner, Inc survey conducted among 320 supply chain leaders in December 2021 and January 2022 found that 27 percent of respondents have done a climate change risk assessment to evaluate their most critical supply chain risks. Heather Wheatley, senior director analyst with the Gartner Supply Chain practice said that it is possible to model risks emanating from climate change with the help of newer technologies, highlighted the report.

|

|

The pandemic has forever altered companies' forecasting strategy, argued Kevin Beasley, CIO at VAI, in an opinion piece. He asked readers to integrate data from the past two years and adjust their forecasting strategy. New technologies including machine learning, predictive analytics capabilities, integration of external data sources and strengthening of relationships with suppliers will help companies' hone forecasting strategies and as importantly, make data-driven decisions.

|

|

The European Automobile Manufacturers' Association (ACEA) said that car sales are at their lowest since 1996 because of supply-chain issues and falling demand. Fewer than 900,000 autos were sold last month, making it it's the worst June on record for new auto sales in more than two decades.

|

|

In particular, German companies see supply-chain troubles hampering industrial output for at least 10 more months. Europe's chemical production is also facing supply chain snarls with sources citing a lack of truck drivers during the summer months and rising freight rates as major reasons, reported ICIS.

|

|

There's good news too. The global air industry is making a post-pandemic rebound. Suppliers and manufacturers working against the clock to catch up amid a soaring demand and constrained supply of raw materials,and electronic components.

|

|

In another good news, Volvo Cars, one of Europe's top carmakers, has indicated an easing of global chip shortage. CEO Jim Rowan told CNBC that the company's semiconductor inventory is now "back at full supply." He expressed optimism that the automotive is seeing a bounce-back in consumer demand.

|

|

Interview of the Month

|

|

Dr. Ganesh Associate Partner & Global Lead, Supply Chain Management Center of Competence and Senior Knowledge ExpertMcKinsey and Company

|

|

Do the events of the past two-plus years - the ongoing Russia-Ukraine conflict, the pandemic, the U.S.-China trade tensions - mark the beginning of the end to globalization? In either case, what shape the global supply chain networks of the future could take?

|

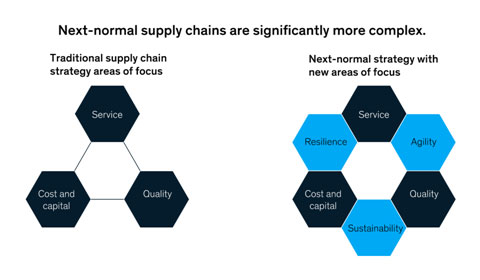

In the past two years, the plumbing of global commerce has taken centre stage in newsrooms and boardrooms, a topic that has rarely been discussed. Today's global supply chains have been exposed by the COVID-19 crisis, post-pandemic economic effects, and ongoing conflict in Ukraine. Teams that keep products moving in a complex, uncertain, and rapidly changing environment have also been elevated to hero status. Supply chain executives are now in a unique position: they have the support of their bosses and a clear mandate to make real change. Chief supply chain officers (CSCOs) have a once-in-a-generation opportunity to fortify their supply chains for the future. By recognising the three new priorities alongside their traditional objectives of cost/capital, quality, and service and redesigning their supply chains accordingly, they can accomplish this. In the first place, supply chain resilience aims to address the problems that have recently become a hot topic of discussion. Agility, the second component, will enable companies to adapt to the rapidly changing and volatile needs of their customers and consumers. Supply chains will play a critical role in the transition to a clean and socially just economy, as recognised by the third principle of sustainability.

|

|

|

Were the supply-chain disruptions that happened during the pandemic - such as the ones that caused the shortage of essential drugs, PPE kits or semiconductors - one-off events or symptomatic of deeper issues afflicting today's supply chains? For example, do they indicate that supply chains of today are built too lean, which makes them vulnerable to unexpected events?

|

Shocks exploit weak spots in value chains and companies. The effectiveness of an organization's risk monitoring, mitigation strategies, and business continuity plans determines its supply chain's vulnerability or resilience. Perishable food and agricultural products, for example, make their value chains vulnerable to delivery delays and spoilage. Unpredictable, seasonal, and cyclical demand industries face challenges. Electronics manufacturers must adapt to short product cycles and holiday spending spikes. Other vulnerabilities are the result of intentional decisions, such as a company's inventory levels, product portfolio complexity, number of unique SKUs in its supply chain, and debt or insurance levels. Decisions can reduce or increase shock vulnerability. A value chain's supplier network structure often causes weaknesses. Complexity isn't a weakness if it provides redundancies and flexibility. But it can tip. Complex networks can obscure vulnerabilities and interdependencies. A large multinational company can have hundreds of tier-one suppliers. Each tier-one supplier has hundreds of tier-two suppliers. The deepest tiers of a large company's supplier ecosystem can include tens of thousands of companies. Just-in-time and lean production systems improve efficiency and reduce working capital. Now they may need to balance just-in-time and "just in case." Having enough spare parts and safety stock can reduce the financial impact of supply disruptions. It helps companies meet demand spikes. Rerouting components and flexing production across sites can keep production going after a shock. This requires robust digital systems and analytics to run response scenarios. When the COVID pandemic hit, an American multinational corporation used predictive analytics to mark down goods and reduce production. The company rerouted products from brick-and-mortar stores to e-commerce, partly through direct-to-consumer online sales through its own training app. American multinational corporation's sales dropped less than its competitors'. Companies must focus on cash management during disasters. The top of a value chain has a vested interest in preserving its supplier networks. Some companies accelerated payments or guaranteed bank loans after the global financial crisis to help key vendors. Businesses and governments can't afford to be unprepared for disasters. Future hypotheticals cost now. These investments can reduce losses, improve digital capabilities, boost productivity, and strengthen industry ecosystems. This rebalancing could deliver a win-win between resilience and efficiency.

|

|

|

Your scholarly work on the practice of logistics outsourcing, particularly the subject of 3PL performance, is highly regarded and cited among the practitioners. What is your quick advice to supply chain managers and leaders in how to best evaluate the performance of their 3PL partners? For example, should the managers be looking chiefly for speed and cost, or should they also look for long-term values like dependability and resilience?

|

Key factors that companies should consider when assessing 3PL Performance are detailed below:

-

Directly or as a broker, 3PLs control transportation and distribution capacity. In contracts with carriers, forwarders, and other intermediaries, they represent customers. But customers must exert control. Undefined expectations is a common reason 3PL partnerships fail. Scope creep causes lax control. Outsourcers must assertively communicate goals and concerns and benchmark KPIs that are important to them, not their service provider. A 3PL may provide world-class service, but a customer won't know unless they compare data to contractual or industry standards.

-

3PLs help customers optimise transportation and logistics to add value. They collect and distil mass amounts of data to granular detail, analyse it, and identify anomalies and redundancies. They can then fix specific processes, such as guiding customers toward a core carrier group or enforcing inbound routing guide compliance among suppliers. Or, they may find systemwide improvements upstream and downstream in the supply chain that turn problems into new opportunities to boost efficiency and economy. Because of supply chain change and variability, optimization is ongoing. Once goals are met, new ones should be set.

-

Reports are key to understanding and recognising 3PL performance, good or bad. 3PLs should provide shipment visibility and process information. Customers must choose which status reports are most important to them so they can view performance on their terms, not the provider's. The right metrics can help companies determine if they're balancing service and cost. 3PLs collect, archive, and analyse historical reports to identify improvement areas, alert customers to real-time or recurring problems, and explore opportunities for efficiencies and cost savings.

-

Execution: 3PLs should aim for continuous improvement, and customers should expect it. If a service provider is responsive to customer priorities and executes according to plan, there should be gains in customer service, efficiency, cost savings, and innovation. The evaluation starts over.

|

|

|

In recent years, India's logistics companies, whether express or B2B, have truly raised their game in getting the needed supplies to people, whether it has been the lifesaving drugs, groceries, or vaccines under distressing conditions. This has shown that our logistics sector holds great potential, however, the sector is hamstrung by a host of issues like high logistics costs, a highly fragmented industry, etc. From your perspective, what are the top industrywide or organizational measures that can really unlock the true potential of the sector?

|

Only a shift to more formal, technologically capable organisations may allow the sector to meet future challenges, including whether, when, and how the COVID-19 crisis will end, and the unknown unknowns. The pandemic has made agility and technological sophistication a survival necessity, not a competitive advantage. Small, informal logistics players in the country's supply chains (like the firms that operate 75% of India's trucks) can't adapt to rapid technological change. Large logistics companies may struggle. Large and small organisations face threats.Larger logistics companies may turn to AI, blockchain, and other technologies to ease the cash crunch and other issues. Information sharing with logistics providers will be more important than ever. To transform, companies may seek tighter control over their supply chains, so contracts with logistics and other suppliers may change (for example, by adopting smart contracts mentioned in the sidebar "Digital logistics").Companies with the resources and know-how to adapt will benefit. McKinsey's Travel, Logistics & Infrastructure Practice estimates that advanced technology could reduce logistics costs by 25%, improve service, and free internal capacity.Already, large, foreign-based companies are changing the logistics sector. Supply chains are being bolstered. India's national government has relaxed regulations to allow BVLOS drone testing in designated areas. Food and grocery delivery companies, budget airlines, and drone start-ups have received approval to test BVLOS drones, which could revolutionise last-mile deliveries. Multiple logistics players are adopting new technologies, like blockchain, or forming partnerships to improve operational efficiency. Organizations are helping employees improve their digital skills.

3PLs looking to implement multi-client operations should take four steps.

-

Proactively offer services. 3PLs could create an e-commerce service function to develop a portfolio of standard services customers can mix and match.

-

Restructure business. This includes redesigning the go-to-market model and adjusting pricing to fit a new operating model and customer base.

-

Redesign warehouse operations for clients. In the new model, a warehouse could include complementary client verticals and services, enhanced inventory-management capabilities, dynamic resource allocation between clients, and scalable and modular automation solutions.

-

Create end-to-end connectivity with flexible technology. 3PLs can create a tech stack that integrates with customers at all points and helps with fulfilment (from inventory management to returns) and labour planning.

|

|

|

Will connect again next month, with a comprehensive dossier of news, trends and events from the industry.

|

|

|

|

|

|

|